2023 4th Quarter: The Real Estate Market and Mortgage Rates.

What’s going on with the real estate market? Can prices keep going up? How will my kids ever be able to buy a home? All valid questions which can only be answered by looking at the market with an experienced REALTOR® then siting down with a lender or your financial planner. From there the question is, “Why am I making this move?” With the right information from people you can trust, the decision isn’t marred with fear it is made with confidence. Let’s take a look at some market information. All data is from NWMLS Data base.

Washington State:

There is such a wide variety of homes and lifestyles to choose in Washington state. The west side of the maintains alone can offer open county rural living, urban high-rise condominiums and family suburb living, all with a wide range of price points.

On the Eastside you will find a slower paced lifestyle. Mostly open land with a few midsized towns and a couple cities such a Spokane.

In the 4th Quarter of 2022 there were 5,194 SOLD/Closed homes and unfortunately 2023 gave us a 16% drop in the number of closed sales statewide.

Mainly because of the lack of available homes, the median SOLD price increased nearly 5% from $575,000 to $601,000.

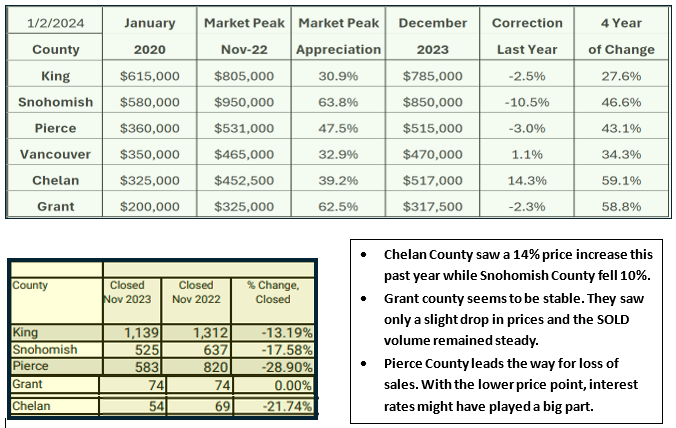

Looking a 6 Washington Counties:

I am going to focus on 6 of the 26 counties served by the Northwest MLS. King, Pierce and Snohomish because these are in my backyard and more important to my client base. I have also selected Chelan , Grant and Vancouver counties. Mainly because they come up often in conversations.

We see a SOLD price story that should be a happy compramise for both sellers and buyers. For the buyers, we have seen SOLD prices settle in most counties. Sellers on the other hand may still be in a positive position with double digit appreciation over the past 4 years

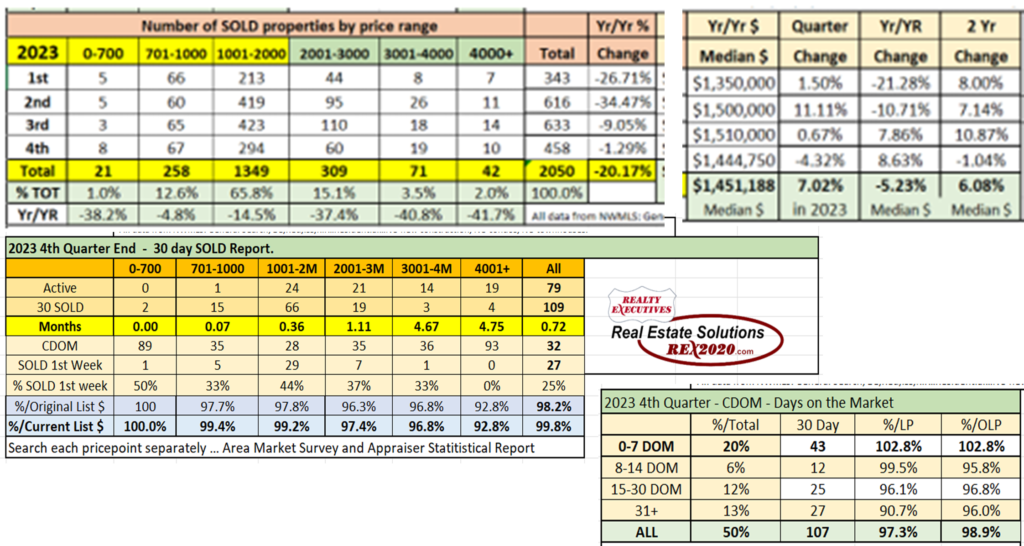

Years End Seattle’s Eastside Real Estate Market report.

We all know that Seattle’s eastside is considered the most expensive market in the state. As we saw in the preceding numbers the median price in King county is $785,000 while Seattle’s Eastside is at $1,450,000, almost double the county number.

That doesn’t mean that everything is roses for sellers, buyers can see some hope in the year end numbers.

- Prices have dropped 5% year over year (YOY) to $1,451,188.

- The number of SOLD properties has fallen 20% YOY.

- The number of homes SOLD in the first week has gone from 85% a few years ago to only 20% last month.

- The median SOLD price has dropped below the list price.

- Smart sellers with great REALTORS® SOLD the first week and brought in 102.8% of list price.

- The market is again below 1 month of available homes. King county has just under 2 months.

- Only 13% of the SOLD homes are priced under $1M. The bulk of the market, 65% are priced between $1M and $2M. The remaining 20% are $3M and more with the highest SOLD price last year was a home in Medina at $38M.

What does this informaton mean to you?

Well for most, this might just give you a better understanding of the market and a few talking points to sound brilliant. But If you have been planning on making a move, hopefully it gives you more awareness. Prices are always on the move and the market is always changing. It’ can be complicated, frustrating and downright scary. Every county, city and neighborhood will have a different story. It’s a good idea to check with an experienced REALTOR® periodically about the value of your home or the target market for your future purchase.

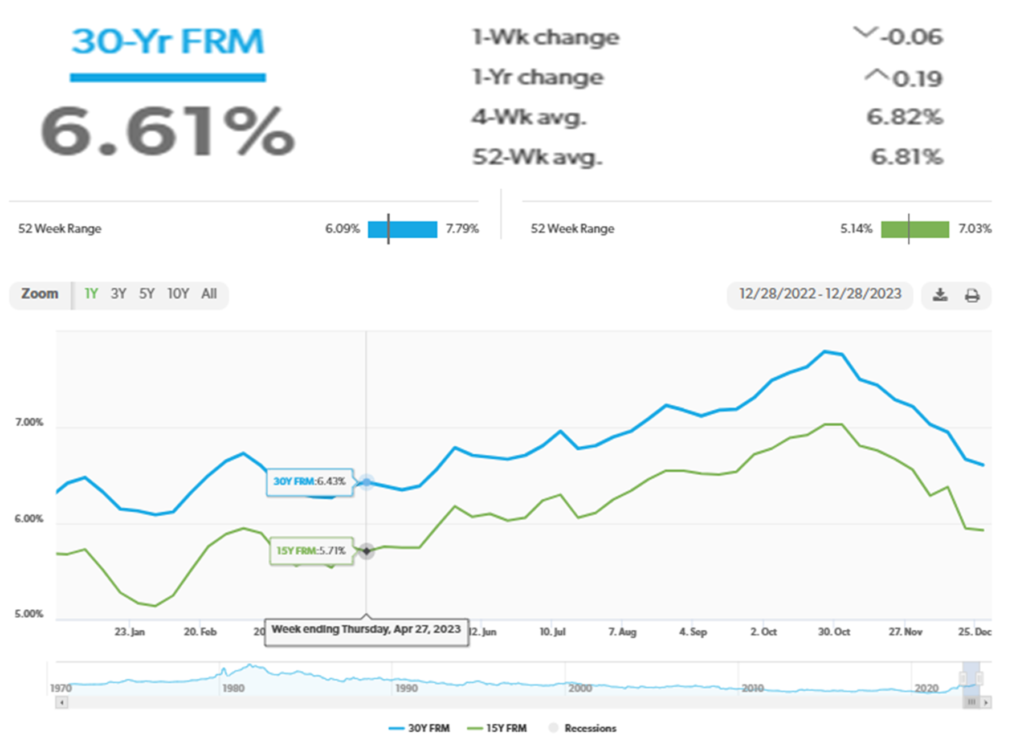

Keep your eye on Mortgage Rates:

My favorite chart is from FreddieMac. On Thursday October 26th. 2023 the 30 year fixed mortgage rate was 7.79%. Look at my blog “The History of Mortgage Rates” to get a clear understanding of rates. Ask your lender about the options for buyers that dodge the high rates and get you into a home. Ask about a future refinance!

Heading into the New Year, Mortgage Rates Remain on a Downward Trend

December 28, 2023. FreddieMac

The rapid descent of mortgage rates over the last two months stabilized a bit this week, but rates continue to trend down. Heading into the new year, the economy remains on firm ground with solid growth, a tight labor market, decelerating inflation, and a nascent rebound in the housing market

Looking Forward:

I can only look at historic data to see trends that are reoccurring. There are five tendencies in our real estate market that I pay close attention to for my clients.

- Inventory levels of available homes start to noticeably increase toward the end of February and leading into March.

- SOLD prices continue to rise through the second quarter.

- Home prices level off or slightly decline in the middle to end of the third quarter.

- Sellers remain in control of the market up to 3 to 4 months of inventory.

- It would be remarkable and unlikely for the interest rate to drop below 6% any time soon. Remember, there are financial options to help with the interest rates and there may always be a refinance opportunity in the next few years.

Leave a comment below if you have questions about the market, your specific neighborhood or if you have been thinking about a move and have any questions about timing …

Check REX2020.com for more blog posts and information about the market and strategies for sellers and buyers and Contact Tom Directly with any questions you may have.

Not all agents are REALTORS®. We are held to a higher standard. Beyond education, we are held accountable to the Code of Ethics. Always ask, “Are you a REALTOR®?”