Accepting Mortgage Rates is a Big Ask.

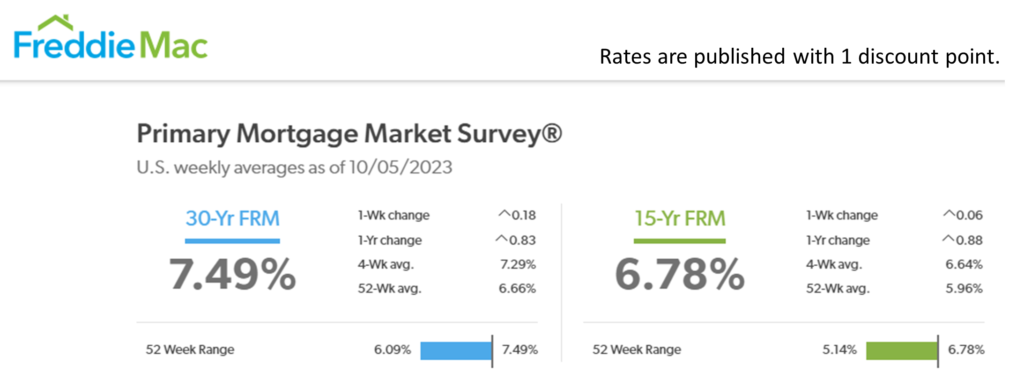

Oh my, Mortgage rates are insanely high. We were approved for an $800,000 loan when the rate was 6% and my Pi payment was $4,800 a month. Today at 7.49% the Pi payment is $5,590 and with our income to debt ratio, we don’t qualify. So, today, we can only afford a $687,000 loan.

The increase in interest rates was bound to happen. However, the increase was rather abrupt for a number of reasons. The covid shutdown, the personal and business emergency funds. The fed policies to artificially keep inflation down and the increased debt load from the borrowed money to support the programs. Then there are the expenditures the US is sending to Ukraine for defending against the Russian invasion. Add to that the interruption to the world supply of oils and our gas prices. All of this adds up to Inflation and higher interest rates for credit. (I’m not an economist. You can always add to or argue with these reasons)

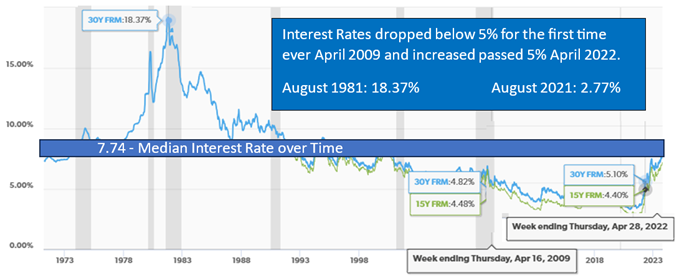

But, looking at the big picture, what does this all mean? For 13 years, mortgage rates were at or below 5%. The median age of a home buyer is 36. So, interest rates were below 5% as these millennials were just getting out of college. Also, during that time, we had a huge influx of tech immigration from other countries. 3% and 4% is all these buyers know. Of course, they are upset, worried and frustrated.

See the chart below for a look at mortgage rates over time.

No one knows for sure if we will see 5% mortgage rates in the next few years, or even 6%.

But if we do, you can always refinance!

Check REX2020.com for more blog posts and information about the market and strategies for sellers and buyers. This information is valuable and timely for today’s real estate market.

While on my website, you can see my step-by-step processes for Sellers and Buyers. Both are based on the current market and proven by my years of experience. Whether it’s time to buy now or in the future, you will receive options that will help you to put a plan of action in place. Contact Tom Directly

Not all agents are REALTORS®. We are held to a higher standard. Beyond the education, we are held accountable to the Code of Ethics. Always ask, “Are you a REALTOR®?”